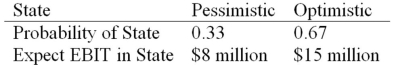

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Investing

Assigning financial resources with the aim of realizing a return or gaining profits.

Purchase of Stock

The act of buying shares in a company, either through a stock exchange or directly from the company.

Investing Activities

Financial transactions related to the acquisition or sale of long-term assets and other investments not considered as cash equivalents.

Statement of Cash Flows

A report detailing the impact of variations in balance sheet positions and income on cash and cash equivalents, segmented into operating, investing, and financing activities.

Q11: Suppose your firm is considering two mutually

Q13: Suppose your firm is considering investing in

Q44: What is computed by dividing the amount

Q51: A pro-rata distribution of additional shares of

Q69: Which of the following statements is incorrect?<br>A)Stock

Q76: Suppose your firm is considering investing in

Q81: You are evaluating a project for your

Q97: You are evaluating a product for your

Q118: Which of these is a company that

Q125: Tools that multinationals can use to help