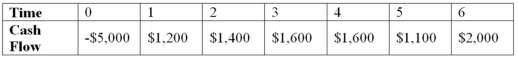

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Volatile Demand

Demand for a product or service that experiences frequent, unpredictable changes often leading to challenges in inventory management and production planning.

Stable Demand

Describes a market condition where the demand for a particular product or service remains consistent over time.

Static Budget

A budget that does not change or adapt with variations in sales volume or business activity levels, typically set for a specific period.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity.

Q8: You are evaluating a product for your

Q25: Which of the following statements is correct?<br>A)A

Q57: Which of the following is defined as

Q67: GBH Inc.is planning on announcing a 7-for-3

Q70: PNB Cos.has sales of $250,000 and cost

Q83: Hastings Entertainment has a beta of 1.24.If

Q89: HiLo,Inc.,doesn't face any taxes and has $100

Q102: An asset's cost plus the amounts you

Q104: PNB Industries has 20 million shares of

Q109: Expected Return A company's current stock price