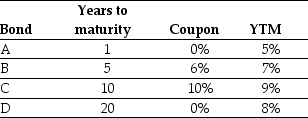

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-The percentage change in the price of the bond "A" if its yield to maturity increases from 5% to 6% is closest to:

Definitions:

Variable

A characteristic, number, or quantity that can change or vary, often used in research to measure and analyze differences or effects.

Experimental Group

A group in a scientific study that receives the treatment or intervention being tested, allowing researchers to measure the effect of the treatment.

Control Group

In experimental research, the group of subjects not exposed to the treatment, used as a benchmark to measure the effect of the treatment group.

Randomization Technique

A method used in experiments to randomly assign subjects to different groups to reduce bias and ensure the groups are comparable.

Q11: The Sisyphean Company's common stock is currently

Q15: To insure their assets against hazards such

Q16: Spark Company's static budget is based on

Q18: When would a sales price variance be

Q28: Corporate governance is best defined as:<br>A) the

Q35: Assuming that the Japanese and Mexican subsidiaries

Q38: Assuming you get 50% control of Associated

Q43: Assuming you currently have 10,000 Bbls of

Q69: Howard Company provided the following selected information

Q82: Which of the following statements regarding arbitrage