Use the following information to answer the question(s) below.

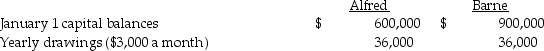

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-What is the total amount for the allocation of interest,salary,and bonus,and how much over-allocation is present?

Definitions:

Identify The Problem

The process of recognizing and defining the issue that needs to be addressed or solved.

Spammers

Individuals or entities that send unsolicited messages, especially advertising, in large quantities over the internet.

Disaster Recovery Plans

Strategies and procedures developed to restore hardware, applications, and data crucial for organizational operations after a disaster.

Disk Cleanup

A computer maintenance utility designed to free up disk space on a computer's hard drive by deleting unnecessary or temporary files.

Q2: Shoreline Corporation had $3,000,000 of $10 par

Q2: On October 15, 2014, Napole Corporation, a

Q9: A parent company regularly sells merchandise to

Q16: On January 1, 2011, a Voluntary Health

Q18: Dana contributes $2,000 too much to a

Q20: In a nonprofit, nongovernmental hospital, courtesy allowances

Q27: Nettle Corporation is preparing its first quarterly

Q30: A summary balance sheet for the partnership

Q39: Assume Paris's inventory account had a book

Q154: Daniel just graduated from college.The cost of