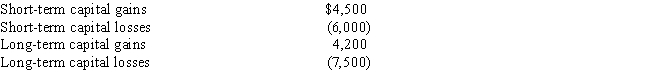

During the year Wilbur has the following capital gains and losses:

What is the effect of the capital gains and losses on Wilbur's taxable income?

Definitions:

Termination

The process of bringing an end to something, such as a contractual agreement, employment relationship, or legal obligation.

Dissociation

The process by which a partner leaves a partnership, altering the relationship among the remaining partners and potentially affecting the partnership's continuation.

Dissolution

The closure or termination of an entity’s existence, such as a corporation or partnership, through legal processes.

Winding Up

The process of dissolving a company, involving the cessation of business operations, selling of assets, and distribution of proceeds to creditors and shareholders.

Q23: Bowden is a single individual and has

Q24: Personalty<br>A)Land and structures permanently attached to land.<br>B)Property

Q57: Homer and Marge are married and have

Q58: During 2016,Marsha,an employee of G&H CPA firm,drove

Q65: Mei-Ling is a candidate for a master's

Q77: Income realization may occur as a result

Q91: Willie sells the following assets and realizes

Q98: When Rick found out that Ryan's liabilities

Q108: Ricardo owns interests in 3 passive activities:

Q118: Erline begins investing in various activities during