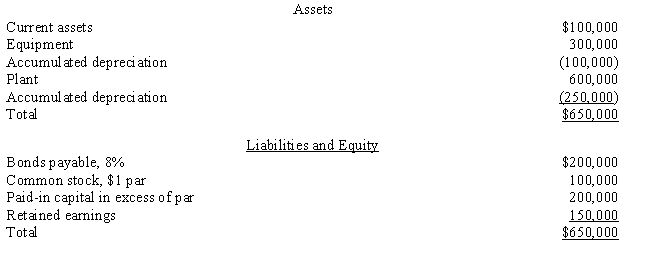

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash.The balance sheet for the Don Company on the date of acquisition showed the following:

?

?

Required:

Required:

?

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000.Assume that the Chan Corporation has an effective tax rate of 40%.Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

?

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.?

?

b.The bonds have a current fair value of $190,000.The transaction is a taxable exchange.?

?

c.There are $100,000 of prior-year losses that can be used to claim a tax refund.The transaction is a taxable exchange.?

?

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due.The transaction is a taxable exchange.?

Definitions:

Kitchen Cabinets

Furniture installed in many kitchens for storage of food, cooking equipment, and often silverware and dishes.

Wood

Wood is a hard, fibrous material derived from trees and used in construction, manufacturing, and as a fuel source among other purposes.

Increase In Price

This occurs when the cost of a good or service rises, which can be influenced by various factors such as supply and demand, production costs, and inflation.

Ice Cream

A frozen dessert made from dairy products, such as milk and cream, often combined with fruits, flavors, or other ingredients.

Q2: What is the approach of the Canadian

Q4: If a U.S.Company purchases inventory on account

Q5: Company A purchased a 90% interest in

Q21: Company A purchased 90% interest in Company

Q25: On January 1, 2016, Pope Company acquired

Q29: What is occurring when the term concessions

Q34: According to Richard Chaykowski and Anil Verma,

Q35: Which of the following statements applying to

Q48: The Chan Corporation purchased the net assets

Q53: Once a certification order is in place,