REFERENCE: Ref.03_07

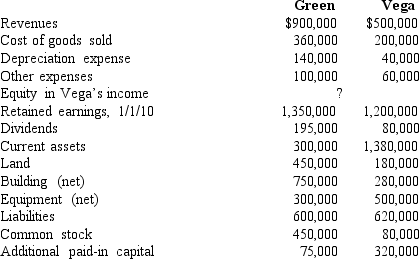

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated buildings.

Definitions:

Conception

The process of fertilization where a sperm and egg combine to form a zygote, initiating pregnancy.

Inherited Genes

Genes passed down from parents to offspring, determining various biological traits and predispositions.

Developing Diabetes

The process of acquiring diabetes, a metabolic disease characterized by high blood sugar levels over a prolonged period.

Personality

An individual's exclusive set of emotional feelings, attitudes, and behaviors.

Q9: What amount of goodwill should be attributed

Q13: On January 1,2009,Parent Corporation acquired a controlling

Q21: Compute consolidated inventory at date of acquisition.<br>A)$1,650.<br>B)$1,810.<br>C)$1,230.<br>D)$580.<br>E)$1,830.

Q41: Required:<br>Determine the noncontrolling interest in Lawrence Co.'s

Q43: If the parent's net income reflected use

Q45: A five-year lease is signed by the

Q66: One company acquires another company in a

Q69: Strayten Corp.is a wholly owned subsidiary of

Q80: On January 1,2009,Rand Corp.issued shares of its

Q97: Compute Chase's attributed ownership in Ross.<br>A)40%.<br>B)64%.<br>C)24%.<br>D)32%.<br>E)12.8%.