Figure:

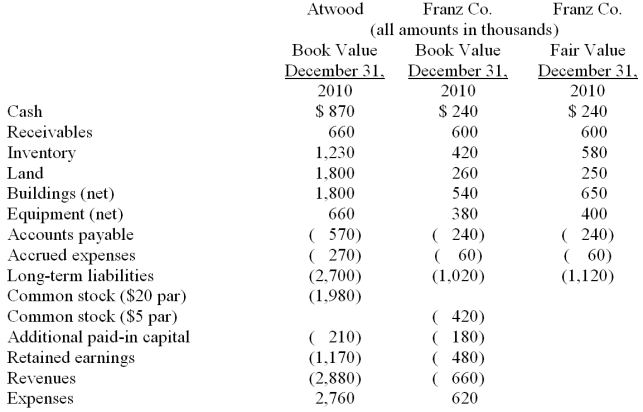

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated revenues at date of acquisition.

Definitions:

Human-Capital

The skills, knowledge, and experience possessed by an individual or population, viewed in terms of their value or cost to an organization or country.

Social-Capital

The interconnected web of interactions among individuals residing and operating within a specific community, facilitating the smooth functioning of that society.

Income Inequality

The uneven distribution of income within a population, leading to financial disparity among its members.

Official Definition

An explicitly stated and widely accepted explanation or meaning of a word or concept, often provided by a reputable or governing authority.

Q17: Compute the book value of Vega at

Q18: Davidson,Inc.owns 70 percent of the outstanding voting

Q24: Marie Todd works for the City of

Q25: Proprietary funds are<br>A)Funds used to account for

Q46: By what methods can a person gain

Q48: The marshaling of assets doctrine regulates claims

Q51: The partnership of Rayne,Marin,and Fulton was being

Q57: When should property taxes be recognized under

Q61: The trustor is the<br>A)income beneficiary of the

Q82: Which of the following statements is true