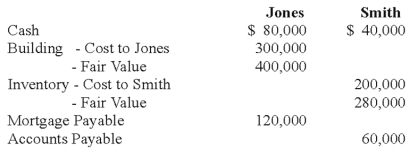

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is each partner's tax basis in the Jones and Smith partnership?

Definitions:

Long-run Supply Curve

A graphical representation showing the relationship between the price level and the quantity of output that producers are willing to supply, taking into account all factors of production can be varied.

Profitable Output

The production or output level from a business operation that generates a financial gain or profit.

Firm

An organization engaged in commercial, industrial, or professional activities, typically with the aim of earning a profit.

Long-Run Supply Curve

A graphical representation showing the relationship between the price of a good and the quantity supplied over a period when all factors of production can vary.

Q22: In cases of operations located in highly

Q23: At the end of the year,a parent

Q24: The Statement of Realization and Liquidation contains

Q28: Typically,the plan of reorganization must be approved

Q29: Salaries Payable would be recorded in the

Q33: The following information was obtained from the

Q37: Transaction: A gain was realized from the

Q47: On December 31,20X7,Planet Corporation acquired 80 percent

Q69: The following information is for employee Ella

Q155: Current assets / Current liabilities<br>A)Current ratio<br>B)Working capital<br>C)Quick