The following information pertains to questions

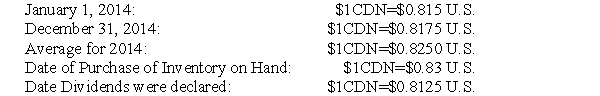

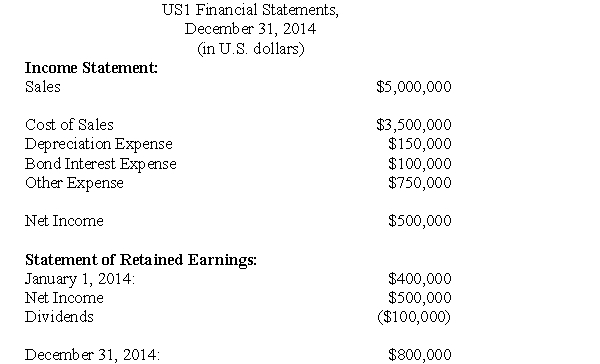

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

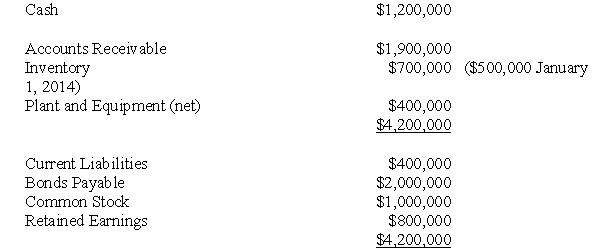

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-For the sake of simplicity,assume once again that US1's cost of sales was calculated to be $4,000,000 CDN.What is the amount (in Canadian dollars) of US1's net income?

Definitions:

Bilateral Pneumonia

An infection affecting both lungs, often caused by bacteria, viruses, or fungi, leading to inflammation and difficulty breathing.

Grimacing

The act of making a facial expression, often in response to pain or discomfort, characterized by a contorted look that typically signifies displeasure.

Incisional Pain

Pain that occurs at the site of a surgical incision, typically as part of the post-operative healing process.

Cue

A signal or prompt that triggers an action or response.

Q13: Ignoring income taxes and any minority interest

Q18: Which of the following rates would be

Q22: Which of the following rates would be

Q41: Goodwill can best be described as:<br>A)The difference

Q41: When the cost object is a unit

Q55: What would be the amount appearing on

Q59: Assuming that Larmer is a joint venture

Q70: Harmel, Inc. incurs the following costs each

Q71: Which of the following methods of accounting

Q85: Discretionary costs reflect:<br>A)The costs that managers incur