Calculations and analysis should be based on current Canadian GAAP.

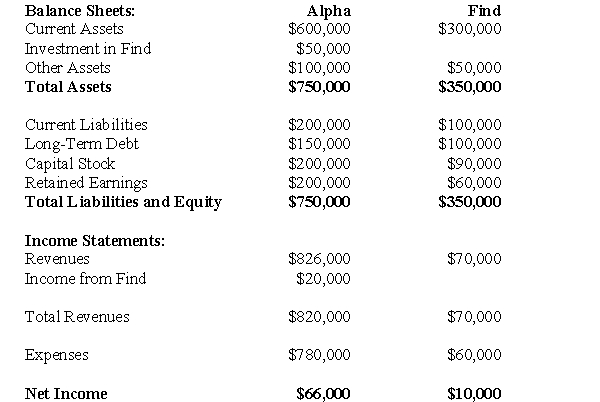

On January 1,2006,Alpha,Beta and Gamma agree to enter into a joint venture and thereby formed Find Corp.Alpha contributed 40% of the assets to the venture,which was also its stake in the venture.Presented below are the financial statements of Alpha and Find as at December 31,2010:  Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha supplies Find with an important component that is used by Find as it carries out its business activities.The December 31,2010 inventory of Find contains items purchase from Alpha on which Alpha recorded a gross profit of $10,000.Intercompany sales are always priced to provide the seller with a gross margin of 40% on sales.Both companies are subject to a tax rate of 40%.On December 31,2010,Find still owed $5,000 to Alpha for unpaid invoices.

-Prepare a schedule of intercompany items as at December 31,2010.

Definitions:

Service Charge

An additional fee added to a customer's bill for the provision of certain services.

Bank Statement Balance

The total amount of money that is available in an individual's bank account at the end of a given period, according to the bank’s records.

Checkbook Balance

The current amount of money recorded in a checking account, according to the account holder's records.

Outstanding Checks

Checks that have been written and recorded in the check register but have not yet been cleared or deducted from the account balance by the bank.

Q15: What was the amount paid to RNB

Q22: What is Victor's portion of any unrealized

Q28: Subject: _ <br>Audience: hikers who don't know

Q31: What is the correct method of treating

Q42: Big Guy's Consolidated Retained Earnings for the

Q49: What would be the amount appearing on

Q59: What would be Errant's journal entry to

Q60: Bill, the controller of CRV Corporation, is

Q61: Company A makes a hostile take-over bid

Q94: Biases are:<br>A)Necessary for decision-making<br>B)Expert opinions<br>C)Ideas that are