The following information pertains to questions

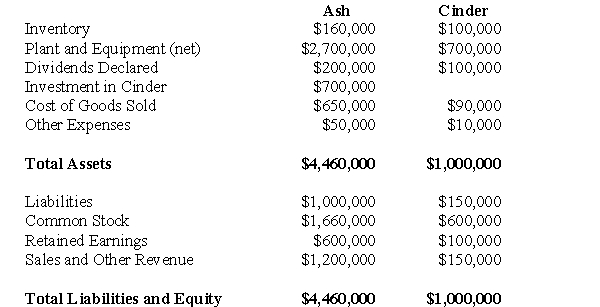

The trial balances of Ash Inc.and its subsidiary Cinder Corp.on December 31,2006 are shown below:  Other Information:

Other Information:

Ash acquired Cinder in three stages:

January 1,2006: Ash purchased 10,000 shares for $100,000.Cinder's Retained Earnings were $40,000 on that date.

January 1,2008: Ash purchased 30,000 shares for $450,000.Cinder's Retained Earnings were $80,000 on that date.

December 31,2009: Ash purchased 20,000 shares for $150,000.Cinder's Retained Earnings were $100,000 on that date.

Cinder was incorporated on January 1,2004.On that date,Cinder issued 100,000 voting shares.Any difference between the cost and book value for each acquisition is attributable entirely to trademarks,which are to be amortized over 5 years.The company has neither issued nor retired shares since the Date of Incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1,2008.These assets had a 10 year remaining life.

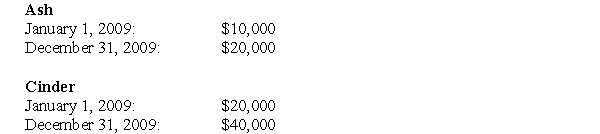

Intercompany Sales of Inventory amounted to $250,000.Unrealized inventory profits for each company are shown below for 2009.The amounts indicate the amount of profit in each company's inventory.  All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

-Compute consolidated trademarks for Ash as at December 31,2009.

Definitions:

Deviant

An individual or behavior that deviates from societal norms, often viewed negatively.

Social Control

Mechanisms, strategies, and institutions by which societies regulate individual behavior to maintain order and conformity.

Masochistic Abuse Personality

A psychological disposition where an individual may derive pleasure from their own suffering or humiliation, potentially leading to seeking out abusive situations.

Psychiatrists

Medical doctors who specialize in the diagnosis, treatment, and prevention of mental illnesses and emotional disorders, capable of prescribing medication.

Q7: What is the amount of interest expense

Q7: Calculate the exchange gain or loss that

Q14: The amount of goodwill arising from this

Q36: How is an Associate's Income from non-operating

Q38: What is the total amount of miscellaneous

Q41: Assuming that Keen Inc.purchases 80% of Lax

Q44: Assume that X Corp.controls X Corp.X constantly

Q59: What would be the amount of the

Q70: Incremental cash flows are the same as

Q83: Cost accounting information is used for both