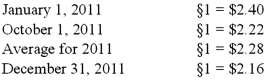

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Predictive Tests

Tests designed to forecast the likelihood of developing diseases or disorders based on genetic, environmental, or lifestyle factors.

Intelligence Tests

Standardized tests designed to measure cognitive abilities and potential, including problem-solving skills, memory, and understanding of concepts.

Test Norms

Standardized values or scores used to interpret individual test results by comparing them to a larger group's performance.

Psychological Test

An assessment tool designed to measure cognitive, emotional, and personality aspects of an individual.

Q1: What is meant by harmonization of accounting

Q8: What exchange rate would be used to

Q20: A local partnership was considering the possibility

Q20: Parker Corp., a U.S. company, had the

Q27: In translating a foreign subsidiary's financial statements,

Q39: Hampton Company is trying to decide whether

Q52: What method is used in consolidation to

Q65: On January 1, 2011, Lamb and Mona

Q69: A partnership began its first year of

Q86: Cleary, Wasser, and Nolan formed a partnership