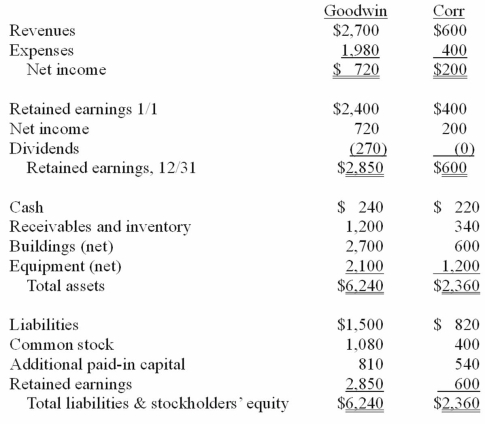

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated cash account at December 31, 20X1.

Definitions:

Data Model

An abstract model that organizes data elements and standardizes how they relate to one another and to properties of the real world.

Outlook Address Book

A feature within Microsoft Outlook that stores and organizes email addresses and contact information.

Word Mail Merge

A feature in Microsoft Word that allows users to create documents (like letters or labels) that are personalized for each recipient from a data source.

Dollar Amounts

Quantitative measures expressed in units of currency, commonly used to refer to sums of money in financial transactions.

Q1: As the speech-language pathologist assigned to the

Q4: The Jolly Rancher cannot end his journey

Q4: Because Amy exhibits VPI,her speech is most

Q4: Parrett Corp. acquired one hundred percent of

Q14: The following are preliminary financial statements for

Q27: Royce Co. acquired 60% of Park Co.

Q35: The financial statements for Goodwin, Inc., and

Q41: Gargiulo Company, a 90% owned subsidiary of

Q92: Jans Inc. acquired all of the outstanding

Q108: On January 4, 2010, Harley, Inc. acquired