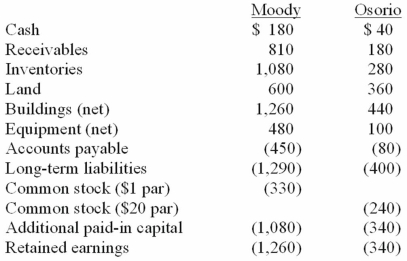

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated equipment at date of acquisition.

Definitions:

Incentives

Factors, either monetary or non-monetary, that motivate individuals or businesses to act in a certain way.

Scarce

A characteristic of resources that are limited in availability, which can lead to competition for their use.

Freely Available

Resources, information, or products that can be accessed or obtained without any payment or restrictions.

Economic Choice

Economic choice involves making decisions on the allocation of scarce resources among competing needs or desires to maximize benefits and utility.

Q1: Five-year old Joey exhibits several key indicators

Q3: The normal swallow consists of two phases,oral

Q6: Reliance on test scores to the exclusion

Q14: Most children understand more words than they

Q24: The financial statements for Goodwin, Inc., and

Q57: Webb Company owns 90% of Jones Company.

Q69: On January 1, 2011, Jolley Corp. paid

Q71: The financial statements for Goodwin, Inc., and

Q81: X-Beams Inc. owned 70% of the voting

Q95: How are direct and indirect costs accounted