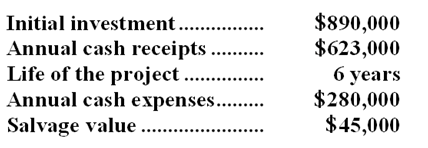

Jenny Inc. has provided the following data concerning an investment project that has been proposed:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 14%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 14%.

-When computing the net present value of the project,what is the after-tax cash flow from the salvage value in the final year?

Definitions:

Q11: When computing the net present value of

Q12: Hasher Hardwood Floors installs oak and other

Q16: If the materials handling cost is allocated

Q26: Findt & Thompson PLC, a consulting firm,

Q47: What is the overhead cost assigned to

Q48: An avoidable cost is a cost that

Q55: What is the overhead cost assigned to

Q71: Assuming that the company charges $613.98 for

Q112: The activity rate for the Processing activity

Q222: The administrative expenses in the planning budget