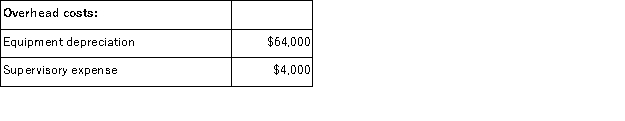

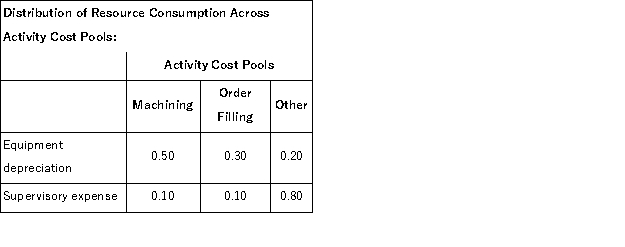

Vontungeln Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

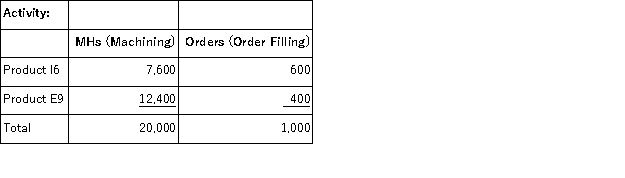

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.

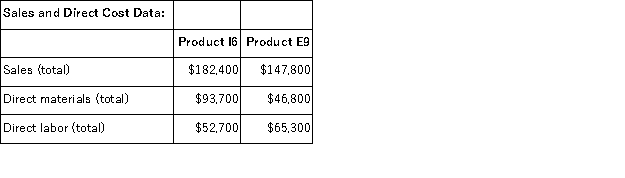

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.  The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Income Tax Bracket

A range of incomes taxed at a particular rate under a progressive tax system.

Regressive Tax

A levy where the rate diminishes as the taxable amount grows.

Payroll Tax

Fees levied on employers or their employees, customarily figured as a percentage of what staff are paid.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, representing the percentage of tax applied to your next dollar of taxable income.

Q12: Under variable costing, which of the following

Q41: If a cost must be arbitrarily allocated

Q41: Feltman Inc.uses a job-order costing system in

Q98: Lafoe Corporation produces two intermediate products, A

Q124: Tullius Corporation has received a request for

Q130: Barnette Corporation has an activity-based costing system

Q138: Consider the following statements: I.A division's net

Q156: The following are budgeted data for the

Q191: A manufacturing company that produces a single

Q219: Criblez Corporation has two divisions: Blue Division