Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

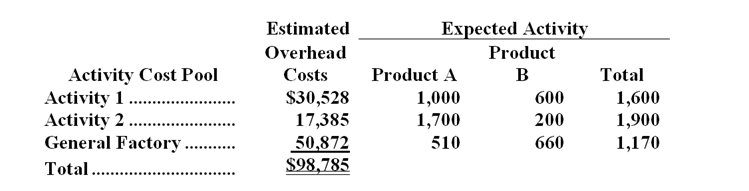

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Temperature Rises

Temperature rises refer to the increase in the thermal energy of a system, which can result in changes in physical state, reaction rates, and physical properties.

Activation Energy Barrier

The minimum energy required for the reactants to undergo a chemical reaction and form products.

Particle Collision

An event where two or more particles come into contact with enough energy to cause a reaction or exchange of properties.

Successful Collisions

Interactions between reactant particles that result in a chemical reaction, dependent on factors like orientation and energy.

Q30: How much cost,in total,would be allocated in

Q32: What is the product margin for Product

Q48: Assuming that all of the costs listed

Q70: The total variable cost at the activity

Q76: The activity variance for selling and administrative

Q80: The unit product cost under absorption costing

Q88: The net income for December would be:<br>A)$66,400<br>B)$43,900<br>C)$47,400<br>D)$61,500

Q101: The break-even point in units for the

Q205: The direct materials in the flexible budget

Q252: The overall revenue and spending variance (i.e.