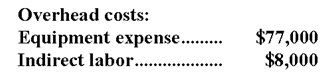

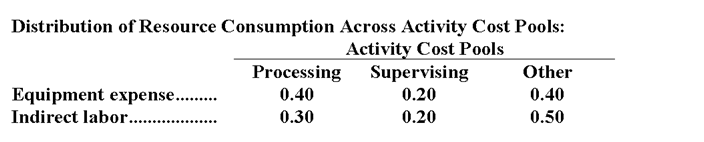

Encarnacion Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:

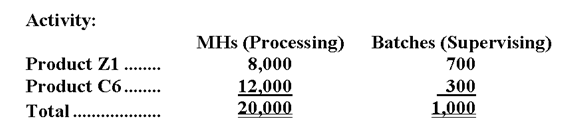

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

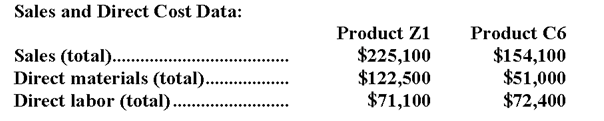

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

-What is the overhead cost assigned to Product C6 under activity-based costing?

Definitions:

Invoices

Documents issued by a seller to a buyer, detailing products or services provided, prices, terms of sale, and payment instructions.

Payroll Documents

Records related to the payment of employees, including details on wages, deductions, and hours worked.

Accounts Payable

The amount of money a company owes to its creditors for goods or services that have been delivered or used but not yet paid for.

Double-Entry Bookkeeping System

An accounting principle where each financial transaction is recorded in two accounts, ensuring the books are always balanced.

Q7: The total number of units produced in

Q24: Under variable costing,costs that are treated as

Q28: Welnor Industrial Gas Corporation supplies acetylene

Q50: Capp Corporation is a wholesaler of

Q81: The direct labor in the planning budget

Q86: The activity variance for administrative expenses in

Q93: The difference between cash receipts and cash

Q110: The total fixed expenses (traceable and common)for

Q144: What was the absorption costing net operating

Q168: Phillipson Corporation has two divisions: the IEB