Having learned in macroeconomics that consumption depends on disposable income,you want to determine whether or not disposable income helps predict future consumption.You collect data for the sample period 1962:I to 1995:IV and plot the two variables.

(a)To determine whether or not past values of personal disposable income growth rates help to predict consumption growth rates,you estimate the following relationship.  t = 1.695 + 0.126 ΔLnCt-1 + 0.153 ΔLnCt-2,

t = 1.695 + 0.126 ΔLnCt-1 + 0.153 ΔLnCt-2,

(0.484)(0.099)(0.103)

+ 0.294 ΔLnCt-3 - 0.008 ΔLnCt-4

(0.103)(0.102)

+ 0.088 ΔLnYt-1 - 0.031 ΔLnYt-2 - 0.050 ΔLnYt-3 - 0.091 ΔLnYt-4

(0.076)(0.078)(0.078)(0.074)

The Granger causality test for the exclusion on all four lags of the GDP growth rate is 0.98.Find the critical value for the 1%,the 5%,and the 10% level from the relevant table and make a decision on whether or not these additional variables Granger cause the change in the growth rate of consumption.

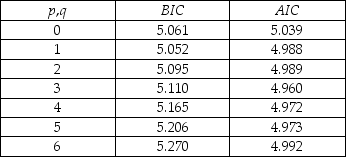

(b)You are somewhat surprised about the result in the previous question and wonder,how sensitive it is with regard to the lag length in the ADL(p,q)model.As a result,you calculate BIC and AIC of p and q from 0 to 6.The results are displayed in the accompanying table:

Which values for p and q should you choose?

Which values for p and q should you choose?

(c)Estimating an ADL(1,1)model gives you a t-statistic of 1.28 on the coefficient of lagged disposable income growth.What does the Granger causality test suggest about the inclusion of lagged income growth as a predictor of consumption growth?

Definitions:

Q1: Money supply is linked to the monetary

Q2: The logic of control variables in IV

Q13: Your textbook presents as an example of

Q20: Consider the sample regression function<br>Yi = <img

Q25: Economic theory suggests that the law of

Q26: One reason for computing the logarithms (ln),or

Q27: Your textbook derives the OLS estimator as

Q50: In time series,the definition of causal effects<br>A)says

Q52: The test statistic for comparing two proportions

Q55: A simple random sample of 60 blood