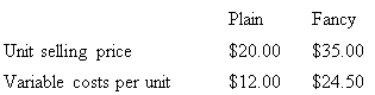

Maxie Pty Ltd makes and sells two types of shoes,Plain and Fancy.Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant.Assume an income tax rate of 20 per cent.The break-even point for this data is 5000 units in total.How will the calculation of the break-even point change (if at all) if the relative percentages of the products in the mix change from 60 per cent Plain shoes to 40 per cent Fancy shoes?

Definitions:

Two-Way Communication

A method of exchange where information is sent and feedback is received, allowing for interactive dialogue.

Corporate Social Responsibility

The voluntary commitment by businesses to include ethical, social, and environmental considerations in their operations and interactions with stakeholders.

Business Activities

The various actions and tasks companies undertake, such as sales, marketing, manufacturing, and management, to operate and achieve their objectives.

Long-Term Strategies

Approaches or plans of action intended to achieve goals and objectives over an extended period, focusing on future outcomes and sustainability.

Q21: Which of the following statements is/are correct?<br>A)

Q27: Which of the following statements regarding capital

Q37: Projects with a zero or positive net

Q39: Abco Pty Ltd is considering the purchase

Q46: Barrister Company has two divisions: A and

Q56: Volo Ltd has recently purchased 2 machines

Q67: Which of the following is the most

Q76: Customer value is an important part of

Q83: Waverly Ltd produces commercial grade washing machines.The

Q89: Would you expect the following to be