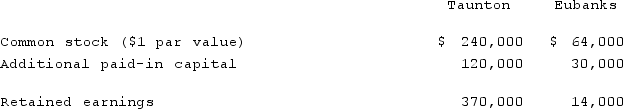

Prior to being united in a business combination, Taunton Inc. and Eubanks Corp. had the following stockholders' equity figures:  Taunton issued 62,000 new shares of its common stock valued at $2.75 per share for all of the outstanding stock of Eubanks.Assume that Taunton acquired Eubanks on January 1, 2020 and that Eubanks maintains a separate corporate existence. At what amount did Taunton record the investment in Eubanks?

Taunton issued 62,000 new shares of its common stock valued at $2.75 per share for all of the outstanding stock of Eubanks.Assume that Taunton acquired Eubanks on January 1, 2020 and that Eubanks maintains a separate corporate existence. At what amount did Taunton record the investment in Eubanks?

Definitions:

Recoverable Amount

The higher value between an asset's fair value minus costs of disposal and its value in use.

Carrying Amount

The amount at which an asset or liability is recognized on the balance sheet after deducting any accumulated depreciation, amortization, or impairment.

Fair Value

An estimate of the price at which an asset or liability would be traded between knowledgeable, willing parties in an arm's length transaction.

Costs To Sell

The direct costs attributable to the disposition of an asset, excluding finance costs and income taxes.

Q2: On January 1, 2021, the partners of

Q3: Jaynes Inc. acquired all of Aaron Co.'s

Q21: On January 1, 2021, the Moody Company

Q31: A local government's basic financial statements would

Q32: The financial statements for Campbell, Inc., and

Q56: Panton, Inc. acquired 18,000 shares of Glotfelty

Q59: The Keller, Long, and Mason partnership had

Q93: Following are selected accounts for Green Corporation

Q105: Jackson Company acquires 100% of the stock

Q107: Following are selected accounts for Green Corporation