The following information relates to Questions 1-10

Samuel & Sons is a fixed-income specialty firm that offers advisory services to investment management companies. on 1 october 20X0, Steele ferguson, a senior analyst at Samuel, is reviewing three fixed-rate bonds issued by a local firm, Pro Star, inc. The three bonds, whose characteristics are given in Exhibit 1, carry the highest credit rating.

EXHiBiT 1 fixed-Rate Bonds issued by Pro Star, inc.

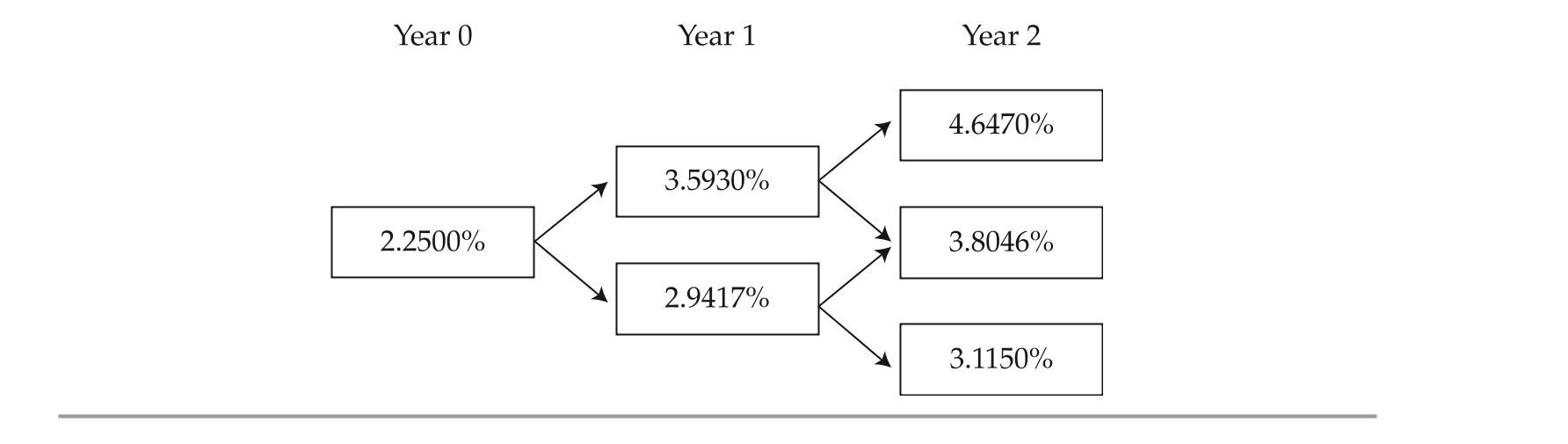

The one-year, two-year, and three-year par rates are 2.250%, 2.750%, and 3.100%, re-spectively. Based on an estimated interest rate volatility of 10%, ferguson constructs the bino-mial interest rate tree shown in Exhibit 2.

EXHiBiT 2 Binomial interest Rate Tree

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

on 19 october 20X0, ferguson analyzes the convertible bond issued by Pro Star given in Exhibit 3. That day, the option-free value of Pro Star's convertible bond is $1,060 and Pro Star's stock price is $37.50.

EXHiBiT 3 Convertible Bond issued by Pro Star, inc.

-All else being equal, if the shape of the yield curve changes from upward sloping to flat- tening, the value of the option embedded in Bond 2 will most likely:

Definitions:

Media Ownership

Media ownership pertains to the control of media enterprises by individuals or corporations, raising concerns about the diversity of views and the independence of media in the context of democracy.

Government-Owned Media

Media outlets such as television, radio, and newspapers that are funded and controlled by the government rather than private entities.

Spin Doctor

A public relations expert skilled in shaping the interpretation of events or communications to favor a particular public image.

News Consultant

Professionals who advise news organizations on various aspects such as editorial content, presentation, and strategies to increase viewership or readership.

Q1: Reaction forces are given in terms of

Q5: Based on Exhibit 2 and Exhibit 3,

Q14: based on exhibit 4 and using Method

Q14: Which comment regarding cdos and covered bonds

Q17: Sovereign bonds are best described as:<br>A) bonds

Q23: as previously mentioned, ibarra is considering a

Q24: Based on Exhibit 2, and assuming that

Q24: Select the graph for following equation.

Q25: Which of the following corporate debt instruments

Q58: Determine whether the Law of Sines