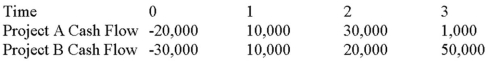

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Capital at Risk

The amount of capital that could be lost in an investment due to risk factors.

Company's Liabilities

Financial obligations a company owes to outside parties, including debts, loans, and other forms of financial liabilities.

Efficient Market

A market in which prices fully reflect all available information and assets are priced accurately.

Moral Hazard

The situation where one party takes risks because they know they will not bear the full consequences of their actions, often due to asymmetric information or contracts.

Q25: ABC Corp.is expected to pay a dividend

Q28: Which of the following makes this a

Q41: The benchmark for the profitability index (PI)is

Q43: Your company doesn't face any taxes and

Q45: List and describe the three basic levels

Q46: When looking at which of these types

Q60: Suppose a firm was planning to greatly

Q67: GBH Inc.is planning on announcing a 7-for-3

Q77: GBH Inc.is planning on announcing a 5-for-2

Q127: Suppose your firm is considering two mutually