The following information pertains to questions

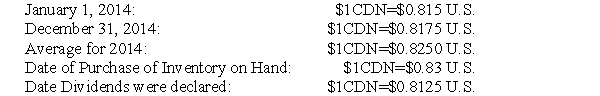

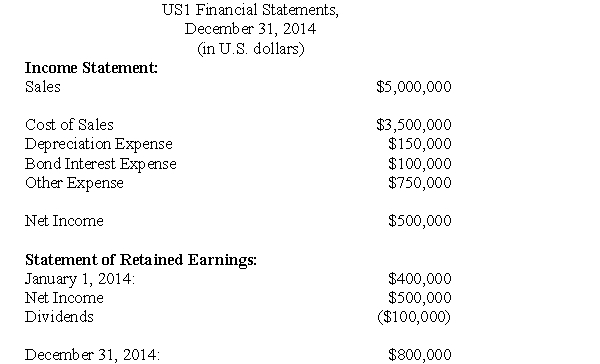

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

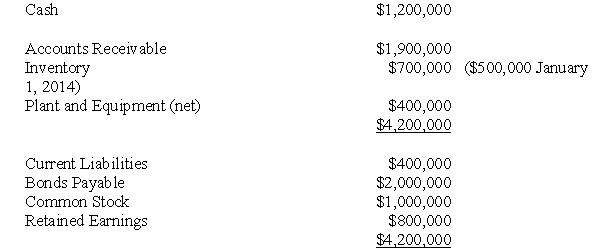

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-For the sake of simplicity,assume once again that US1's cost of sales was calculated to be $4,000,000 CDN.What is the amount (in Canadian dollars) of US1's net income?

Definitions:

M1

A category of the money supply that includes all physical money like coins and currency, as well as demand deposits, checking accounts, and negotiable order of withdrawal (NOW) accounts.

M2

A measure of the money supply that includes cash, checking deposits, and easily convertible near money, such as savings deposits and money market mutual funds.

FDIC

The Federal Deposit Insurance Corporation, a US government agency that insures deposits in banks and thrift institutions.

Bank Deposits

Money placed into banking institutions for safekeeping. These deposits are typically made into checking or savings accounts.

Q4: Using only the Assets test,which of the

Q5: Choosing and implementing a solution to a

Q18: Calculate the non-controlling interest (Balance Sheet)as at

Q23: Prepare an acquisition differential amortization table since

Q27: What would be the amount of the

Q37: What percentage of the Investment in 123

Q41: Assuming that Keen Inc.purchases 80% of Lax

Q59: What would be Errant's journal entry to

Q59: SBN Corporation produces and sells custom cabinets.

Q70: Which of the following cost estimation techniques