The following information pertains to questions

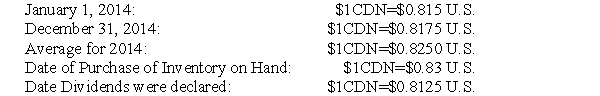

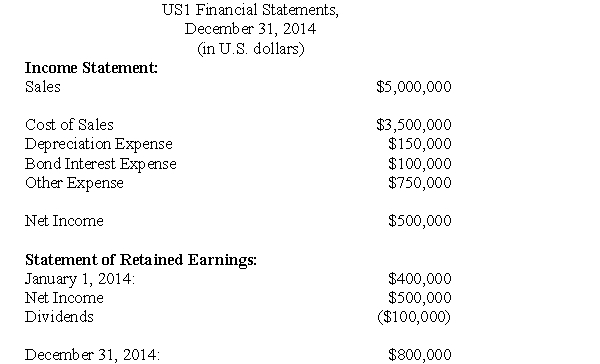

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

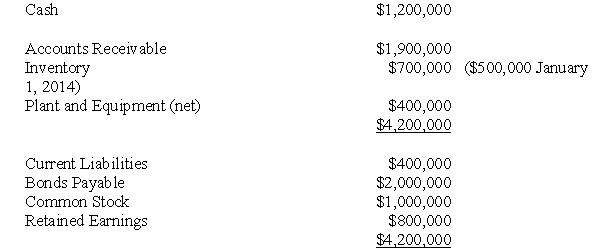

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's bond interest expense for the year?

Definitions:

Break-Even

The juncture where the total expenses match the total income, indicating neither a profit nor a loss is made.

Sales Dollars

The total amount of revenue generated from the sale of goods or services by a company, measured in dollars.

Division Q

A specific segment or section within an organization, referred to as "Q," likely focused on a particular set of tasks or goals.

Contribution Margin Ratio

The percentage of sales revenue that exceeds variable costs, indicating how much contributes to covering fixed costs and generating profit.

Q9: For the sake of simplicity,assume that US1's

Q11: The breakeven point occurs when:<br>A)Sales equal fixed

Q13: Which of the following was often cited

Q17: At what amount (in Canadian Dollars)would RXN's

Q18: The amount of other expenses appearing on

Q20: What would be the amount of Non-Controlling

Q26: Translate Martin's December 31,2011 Balance Sheet into

Q42: What is the amount of the amortization

Q81: The learning curve refers to increases in

Q156: Data extracted from the accounting information system