Analysis and calculations should be made based on current Canadian GAAP.

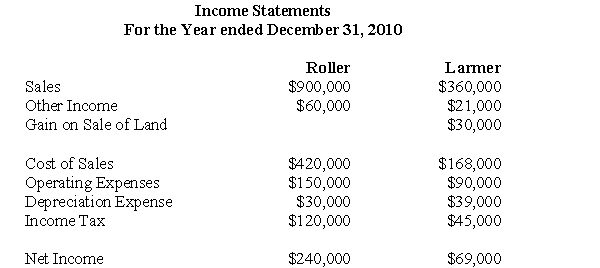

The following are the 2010 Income Statements of Roller Corp and Larmer Corp.  Other Information:

Other Information:

During 2010 Larmer paid dividends of $24,000.Roller acquired its 30% stake in Roller at a cost of $400,000 and uses the cost method to account for its investment.Roller's investment in Larmer shall not be considered a control investment.

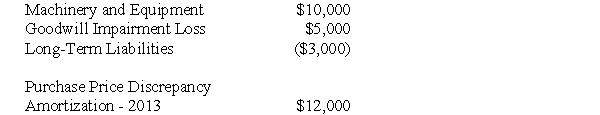

The acquisition differential amortization schedule showed the following write-off for 2010:  During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

In 2010,Roller sold Land to Larmer and recorded a profit of $10,000 on the sale.During 2010,Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

-Assuming that Larmer is a joint venture that is owned by Roller as well as several other unrelated venturers,prepare Roller's 2013 Income Statement in accordance with current Canadian GAAP.In addition,assume that Roller acquired Larmer after its initial formation,thereby validating the acquisition differentials.

Definitions:

Web Cameras

Electronic devices designed to capture and stream video content in real-time over the internet or for video calls.

Information Overload

A condition in which a person cannot process all the messages he or she receives.

Informative Messages

Communications aimed at delivering facts, data, and knowledge to educate or inform the audience.

Selective

Characterized by careful choice; involving the selection of the best or most suitable.

Q2: Prepare a Balance Sheet for Clarke on

Q20: The carrying value of Depreciable Assets on

Q23: Rewards for ethical behavior can include:<br>I. Integrity<br>II.

Q27: Assume that Stanton had other Intangible assets

Q40: What would be the journal entry to

Q41: Calculate Consolidated Retained Earnings as at December

Q50: Prepare YIN's Consolidated Income Statement for the

Q54: The amount of goodwill appearing on Big

Q58: Maude is considering opening her own business,

Q85: Relevant cash flows are<br>A)Avoidable<br>B)Incremental<br>C)Both of the above<br>D)None